Online services vary by participating financial institutions or other parties and may be subject to application approval, additional terms, conditions, and fees. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business https://www.quickbooks-payroll.org/free-online-bookkeeping-course-and-training/ with confidence. Make sure to pick a method that fits your services and makes your clients happy. Ensure that your chosen billing method complies with legal and regulatory requirements in your industry and jurisdiction. This is essential to avoid complications and maintain a positive business reputation.

Top Billing Systems for Small Businesses

While month-to-month invoices might be necessary for some clients, you might want to consider moving some to retainer agreements. With retainer agreements, clients are set up to make recurring payments of the same amount every month. Unfortunately, delayed payments and non-payments are a recurring issue for many entrepreneurs and freelancers. Implementing a follow-up system is essential for managing these situations effectively.

Intake Process Template

It’s like having a personal finance assistant that makes your freelance business so much easier. Additionally, you can accept payments online via PayPal but, if you want other payment options for clients, you’ll have to upgrade to a paid plan. The paid plans do give you useful features, such as payment receipts, automatic payment reminders and quotes or estimates. You can use Zoho Invoice to track your projects, including billable hours, and convert estimates and projects into invoices. Send invoices by email or let clients log into a portal where they can view and approve estimates and pay invoices.

- They also include recording journal entries and accumulating various costs.

- Maintaining positive relationships with clients may even prevent issues from ever arising.

- This ensures that the client’s memory of the project is fresh, increasing the chances of receiving prompt payment.

Send it to the right person

This is true across many industries, for large businesses with international clients to independent contractors simply billing for projects. Old-school timekeeping methods, such as maintaining timesheets or spreadsheets, often lead to billing errors and inconsistencies due to their extensive nature. Tracking billable hours through a dedicated app is a more sensible solution. A 2023 time tracking study suggests that companies using software with timekeeping features were 44% less likely to commit payroll slip-ups. Client billing is crucial for maintaining a healthy cash flow and ensuring a business venture’s financial stability.

Steps to Professional Client Invoices that Encourage Payment

Even though it can be a sensitive matter, it’s important to approach billing with transparency and professionalism. You can either send a friendly reminder email or a message to the client reminding them that payment is due. Don’t forget to be clear and specific about the amount owed, the due date, and the payment methods accepted. If the client has any questions or concerns about the payment process, offer help and provide a deadline for payment to encourage the client to act asap. Your industry might customarily use a particular term of payment, such as 30 days, but you can also set your payment terms based on your own needs. You should also decide whether you want to offer incentives for early payment.

Experience the Magic of Automated Invoicing

There are differences in their billing rates, in what type of work you do for them, in how they are billed, and in other contract terms. He has a habit of penning down his random thoughts and giving words and meaning to the clutter of ideas colliding inside his mind. His obsession with Google and his curious mind add to his research-based writing. Other than that, he’s a music and art admirer and an overly-excited person.

Zoho Invoice may be configured to automatically send payment reminders and track the status of each invoice. This helps assist small and midsize enterprises with invoicing and expenditure management. The platform’s templates enable quick and easy development of quotes and invoices with a professional look. Teamwork.com stands out as the ultimate solution for https://www.kelleysbookkeeping.com/ consultants with its comprehensive project management, time tracking, and invoicing capabilities all in one platform. It allows multiple currencies for international clients and can generate customizable invoices with detailed time entries. Clockify also offers integrations with popular billing platforms like PayPal and Stripe for seamless payment processing.

A consistent influx of payments allows you to plan your budget, pay bills, and invest in your professional development, thereby fostering long-term financial stability. Invoicing software that includes reports, prebuilt or custom, can be an eye-opening feature for businesses. With analytics, you can collect data that will help you make future business decisions. You may discover most of your clients pay invoices from their mobile phones or that your customers rarely check payment reminders.

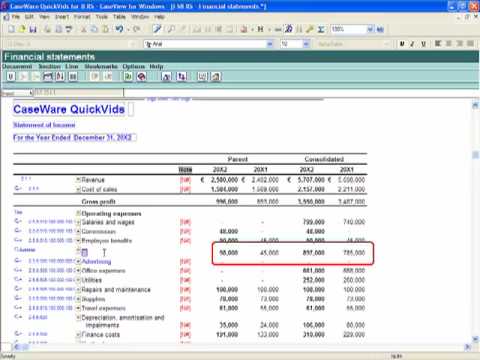

They include features that convert quotes into invoices automatically and track billable hours. Most offer client portals to get the approval of estimates easily so that accrued expenses recognize expenses incurred before paying you can get to work and get paid. QuickBooks can help small businesses get paid faster with comprehensive accounting and invoicing solutions that work hand in hand.

Zoho Invoice is a cloud-based software that allows you to create professional invoices, send payment reminders, and get paid quickly online. The software also offers various payment options for clients, including credit cards and PayPal. Its custom branding features allow consultants to personalize their invoices with their company logo and colors. For streamlined invoicing solutions, consultants can also turn to Clockify.